US Debt Crisis: Understanding the Timeless Reports Analysis

Timeless Reports: A Comprehensive Analysis of the US Debt Crisis and Its Potential Consequences delves into the historical context, current state, and prospective impacts of the escalating national debt, offering critical insights for policymakers and citizens alike.

The United States’ national debt has been a topic of concern for decades, but understanding its complexities and potential consequences requires a comprehensive analysis. Timeless Reports: A Comprehensive Analysis of the US Debt Crisis and Its Potential Consequences provides just that, offering a deep dive into the factors contributing to the debt, its current state, and the possible ramifications for the economy and society.

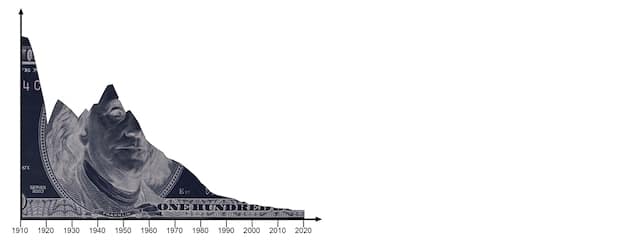

Understanding the Historical Context of US Debt

To fully grasp the current US debt crisis, it’s crucial to understand its historical roots. The accumulation of debt didn’t happen overnight; it’s the result of a series of policy decisions, economic events, and global shifts that have shaped the financial landscape of the nation.

Early Years and Growth of Debt

The US has had debt since its inception, with the Revolutionary War being a significant contributor. However, the scale of debt remained relatively manageable for a long period.

Key Turning Points in Debt Accumulation

Several historical events dramatically altered the trajectory of US debt. World War I, the Great Depression, and World War II led to significant increases in government spending.

- The New Deal programs during the Great Depression expanded the role of the federal government, leading to increased spending and borrowing.

- The Vietnam War and the subsequent social programs of the 1960s and 1970s added further to the national debt.

- Tax cuts enacted during the Reagan administration in the 1980s, combined with increased military spending, contributed to a rising debt level.

- More recently, the financial crisis of 2008 and the COVID-19 pandemic necessitated massive government interventions, leading to unprecedented levels of debt.

Understanding these historical contexts allows us to appreciate how different eras and policies have collectively shaped the current debt landscape. Each period of increased debt was often justified by immediate needs, but the long-term consequences have accumulated over time.

Current State of the US National Debt

The US national debt has reached staggering levels in recent years, surpassing \$34 trillion. This figure represents not just a number but a reflection of the nation’s financial obligations and future economic challenges. Understanding the components of this debt and its implications is essential for informed decision-making.

Breaking Down the Numbers

The national debt is composed of two main categories: debt held by the public and intragovernmental holdings. Debt held by the public includes Treasury securities held by individuals, corporations, foreign governments, and the Federal Reserve. Intragovernmental holdings represent debt owed by the government to its own agencies, such as Social Security and Medicare trust funds.

Debt as a Percentage of GDP

A critical metric for assessing the sustainability of the debt is its ratio to the Gross Domestic Product (GDP). Currently, the US debt-to-GDP ratio is above 120%, a level that raises concerns about the nation’s ability to manage its financial obligations.

- High debt-to-GDP ratios can lead to higher interest rates, making it more expensive for the government to borrow money.

- It can also lead to reduced investor confidence, potentially triggering capital flight and currency devaluation.

- Furthermore, it can constrain the government’s ability to respond to future economic crises or invest in critical areas such as infrastructure, education, and research.

The current state of the US national debt necessitates careful fiscal management and strategic planning to ensure long-term economic stability. Ignoring the issue or delaying action can lead to more severe consequences down the line.

Factors Contributing to the Debt Crisis

The accumulation of US national debt isn’t a simple equation; it’s a complex interplay of various factors, including government spending, tax policies, economic downturns, and demographic shifts. Examining these elements provides a clearer understanding of why the debt has reached its current levels.

Government Spending and Fiscal Policy

Government spending is a primary driver of the national debt. Decisions regarding defense spending, social security benefits, healthcare programs, and infrastructure investments all have a direct impact on the budget deficit and, consequently, the debt.

Tax Policies and Revenue Shortfalls

Tax policies also play a significant role. Lowering taxes without corresponding cuts in spending can lead to revenue shortfalls, increasing the need for borrowing. Tax cuts implemented over the years, while potentially stimulating economic growth, have also contributed to the growing debt.

- The aging population is placing increased demands on Social Security and Medicare, leading to higher spending in these areas.

- Healthcare costs in the US are among the highest in the world, further straining the federal budget.

- Economic downturns, such as the 2008 financial crisis and the COVID-19 pandemic, necessitate government intervention through stimulus packages and unemployment benefits, leading to increased borrowing.

Understanding these contributing factors is essential for formulating effective strategies to address the debt crisis. It requires a multifaceted approach that considers both spending and revenue sides of the equation.

Potential Economic Consequences

The escalating US national debt poses several potential economic consequences that could affect the nation’s financial stability, economic growth, and the well-being of its citizens. These consequences range from increased interest rates to reduced investment and slower economic growth.

Impact on Interest Rates and Inflation

A high level of national debt can lead to increased interest rates. As the government borrows more money, it can drive up the cost of borrowing for everyone, including businesses and individuals. This can stifle investment and economic growth.

Effects on Investment and Economic Growth

High debt levels can also reduce investor confidence. Investors may become concerned about the government’s ability to repay its debts, leading to decreased investment and capital flight. This can result in slower economic growth and reduced job creation.

- A debt crisis can lead to austerity measures, such as cuts in government spending and increased taxes, which can further dampen economic activity.

- High debt levels can limit the government’s ability to respond to future economic crises, making the economy more vulnerable to shocks.

- The burden of debt can be passed on to future generations, reducing their opportunities and living standards.

Addressing the debt crisis is crucial to mitigate these potential economic consequences and ensure a stable and prosperous future for the US economy.

Social and Political Implications

Beyond the economic ramifications, the US national debt also has significant social and political implications. The choices made to address the debt crisis can affect various segments of society and reshape the political landscape.

Impact on Social Programs and Entitlements

Efforts to reduce the national debt often involve cuts to social programs and entitlement programs such as Social Security and Medicare. These cuts can disproportionately affect vulnerable populations, including the elderly, low-income individuals, and people with disabilities.

Political Polarization and Policy Debates

The debt crisis can exacerbate political polarization, as different political ideologies clash over the best approach to address the issue. Policy debates often center on the balance between spending cuts and tax increases, with each side advocating for different priorities.

- Disagreements over the budget can lead to government shutdowns and political gridlock, undermining public trust in government institutions.

- The debt crisis can be used as a political tool to advance particular agendas, further complicating the policy-making process.

- Addressing the debt crisis requires bipartisan cooperation and a willingness to compromise, which can be difficult to achieve in a highly polarized political environment.

Acknowledging these social and political implications is essential for developing comprehensive and equitable solutions to the debt crisis. It requires a commitment to protecting vulnerable populations and fostering constructive dialogue across political divides.

Potential Solutions and Future Outlook

Addressing the US national debt requires a comprehensive and multifaceted approach that combines fiscal discipline, strategic investments, and innovative policy solutions. The future outlook depends on the choices made today regarding spending, revenue, and economic priorities.

Fiscal Responsibility and Budgetary Reforms

Implementing fiscal responsibility involves controlling government spending, reducing wasteful expenditures, and ensuring that taxpayer dollars are used efficiently. Budgetary reforms can help streamline the budgeting process and improve transparency and accountability.

Strategic Investments in Growth and Productivity

Investing in areas such as infrastructure, education, and research can boost economic growth and productivity, generating higher tax revenues and reducing the debt burden. These investments can create jobs, improve living standards, and enhance the nation’s competitiveness.

- Raising taxes on high-income individuals and corporations can generate additional revenue to help pay down the debt.

- Reforming entitlement programs to ensure their long-term sustainability is crucial for controlling future spending.

- Promoting international cooperation and addressing global economic challenges can help stabilize the US economy and reduce its vulnerability to external shocks.

The path forward requires a long-term perspective and a commitment to making difficult choices. By embracing fiscal responsibility, strategic investments, and innovative policy solutions, the US can secure a more sustainable and prosperous future.

| Key Point | Brief Description |

|---|---|

| 📈 Debt Growth | Exponential increase due to policies & crises. |

| 💰 Debt-to-GDP | Ratio exceeds 120%, raising sustainability concerns. |

| 🏛️ Policy Impact | Spending, taxes, and entitlements shape the debt. |

| 🌍 Global Factors | Economic events and cooperation affect US debt. |

Frequently Asked Questions

▼

The US national debt has surpassed \$34 trillion, a significant figure reflecting the nation’s financial obligations.

▼

The national debt is the accumulation of all past budget deficits, while the budget deficit is the difference between government spending and revenue in a given year.

▼

Key drivers include government spending, tax policies, economic downturns, demographic shifts, and healthcare costs.

▼

The US debt-to-GDP ratio is high compared to many other developed nations, raising concerns about sustainability.

▼

Addressing the debt requires fiscal discipline, strategic investments, budgetary reforms, and innovative policy solutions.

Conclusion

Understanding the US debt crisis requires a comprehensive analysis of its historical context, current state, and potential consequences. By addressing the contributing factors and implementing strategic solutions, the US can work toward a more sustainable and prosperous future.