Understanding the Impact of the Updated CPI on Inflation and Your Purchasing Power

The Consumer Price Index (CPI) is a vital economic indicator that measures changes in the price level of a basket of goods and services purchased by households, and its updates significantly impact inflation rates and, consequently, the purchasing power of consumers in the United States.

The Impact of the Updated Consumer Price Index (CPI) on Inflation and Your Purchasing Power is a critical topic for understanding how prices fluctuate and how these changes affect what you can afford. Knowing what influences these metrics can empower informed financial decisions.

Decoding the Consumer Price Index (CPI)

The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them.

Understanding what the CPI is and how it’s calculated helps to paint a basic picture of inflation in the U.S. economy. This measurement offers detailed insights into how the cost of living changes over time, directly affecting the financial decisions of households.

CPI Components

The CPI encompasses a wide array of goods and services, grouped into major categories. This comprehensive coverage ensures that almost every aspect of consumer spending is reflected in the index.

- Food and Beverages: Includes groceries, restaurant meals, and alcoholic beverages.

- Housing: Covers rent, mortgage payments, property taxes, and utilities.

- Transportation: Includes vehicle purchases, gasoline, maintenance, and public transportation fees.

- Medical Care: Covers doctor visits, hospital services, prescription drugs, and medical insurance.

Each category is weighted according to its importance in the average consumer’s spending. Categories that take up a larger portion of household budgets, such as housing and transportation, have a more significant impact on the overall CPI.

In conclusion, the CPI meticulously tracks the prices of a broad spectrum of goods and services, providing a comprehensive understanding of inflation trends and their impact on the cost of living.

The Role of CPI in Measuring Inflation

The CPI is not just a number; it’s a critical tool for measuring inflation, the rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling. Understanding how the CPI is used to measure inflation is crucial for assessing its impact on the economy.

The CPI offers essential insights into the economic health of the country. When the CPI rises sharply, it indicates that inflation is increasing, which can erode the value of money and reduce the affordability of goods and services.

How is CPI Calculated?

The CPI is calculated as a weighted average of price changes for goods and services in a representative basket. This involves several steps to ensure accuracy and relevance.

- Data Collection: The Bureau of Labor Statistics (BLS) collects price data monthly from thousands of retail stores, service establishments, rental units, and doctors’ offices across the country.

- Weighting: Each item in the CPI basket is assigned a weight that reflects its relative importance in the average consumer’s spending.

- Calculation: The CPI is calculated by averaging the price changes for all items, weighted by their respective importance.

Understanding the calculation method helps to interpret CPI changes accurately. A consistently rising CPI indicates sustained inflation, while a declining CPI suggests deflation, which can be equally concerning for economic stability.

In summary, the CPI plays a vital role in measuring inflation by tracking price changes across a wide range of goods and services and adjusting for their importance in consumer spending.

Updated CPI and Its Implications

The CPI isn’t static; it undergoes periodic updates to better reflect current consumer spending patterns and market conditions. These updates are essential for maintaining the accuracy and relevance of the inflation measure.

Changes to the CPI can arise from various factors, including shifts in consumer preferences, technological advancements, and alterations in data collection methods. These changes can have significant implications for how inflation is perceived and managed.

Key Differences Between Old and Updated CPI

When the CPI is updated, several changes can occur to its methodology and composition. These may include:

- Updated Basket of Goods: Introducing new items or removing outdated ones to align with current consumer spending habits.

- Revised Weighting: Adjusting the weights of different categories to reflect changes in their relative importance.

- Methodological Improvements: Incorporating new techniques for data collection and calculation to enhance accuracy.

These updates aim to provide a more accurate reflection of how prices affect the average consumer’s wallet. The changes influence inflation rates and subsequent policy decisions made by the Federal Reserve and other government agencies.

In conclusion, staying informed about updates to the CPI is essential to understand how inflation measurements evolve and adapt to changing economic conditions, directly impacting financial planning and economic policy.

CPI and Inflation: A Clearer Picture

The relationship between the CPI and inflation is straightforward: changes in the CPI directly reflect changes in inflation. However, understanding the nuances of this relationship requires examining different types of inflation and how the CPI captures them.

By tracking the CPI, it’s possible to differentiate between various types of inflation and their root causes. This allows economists and policymakers to formulate more effective strategies for managing inflation and maintaining economic stability.

Types of Inflation

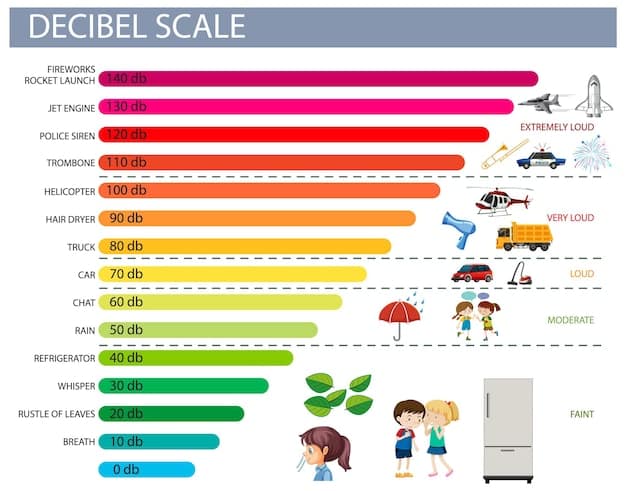

Inflation can manifest in several forms, each with its underlying causes and characteristics. The CPI helps to identify and measure these different types.

- Demand-Pull Inflation: Occurs when there is an increase in aggregate demand that outpaces the economy’s ability to produce goods and services.

- Cost-Push Inflation: Results from increases in the cost of production, such as wages or raw materials, which businesses pass on to consumers.

- Built-In Inflation: Arises from expectations of future inflation, which can lead to wage-price spirals as workers and businesses adjust their behavior accordingly.

The CPI data helps to identify which type of inflation is most prevalent in the economy. For example, a sudden spike in energy prices might lead to cost-push inflation, while increased consumer spending could contribute to demand-pull inflation.

In brief, the CPI is indispensable for understanding the complexities of inflation by measuring its various forms and providing insights into its potential drivers. This enables more informed decision-making to manage inflation effectively.

Impact of CPI on Purchasing Power

Perhaps the most direct and personal impact of the CPI and inflation is on your purchasing power—the ability to buy goods and services with a given amount of money. When inflation rises, the purchasing power of each dollar decreases, meaning you can afford less with the same amount of money.

The relationship between inflation and purchasing power is inverse: higher inflation erodes purchasing power, while lower inflation sustains or increases it. Understanding how this works is essential for managing personal finances effectively.

How Inflation Affects Everyday Expenses

The impact of inflation on purchasing power is felt across various aspects of daily life. Some key areas include:

- Groceries: Rising food prices can make it more expensive to maintain a healthy diet.

- Housing: Increased rent or mortgage payments can strain household budgets.

- Transportation: High gasoline prices can increase the cost of commuting and travel.

- Healthcare: Rising medical costs can make healthcare less accessible and affordable.

These increased expenses mean that consumers need more money to maintain their current standard of living. If income does not keep pace with inflation, purchasing power decreases, leading to financial strain.

In summary, inflation, as reflected in the CPI, has a significant impact on purchasing power, meaning that consumers may need to adjust their spending habits to maintain their economic wellbeing.

Strategies to Protect Your Purchasing Power

Given the impact of inflation on purchasing power, it’s important to develop strategies to mitigate its effects. These strategies can help you maintain or increase your financial stability despite rising prices.

Taking proactive steps to protect your purchasing power can help you navigate inflationary periods more effectively. These steps can involve adjustments to spending habits, investment strategies, and income management.

Practical Tips for Consumers

Here are some actionable strategies that consumers can implement to safeguard their purchasing power:

- Budgeting: Track your expenses and identify areas where you can reduce spending.

- Investing: Consider investments that tend to outperform inflation, such as stocks, real estate, or Treasury Inflation-Protected Securities (TIPS).

- Negotiating: Negotiate for higher wages or salaries to keep pace with inflation.

- Saving: Save strategically, focusing on high-yield savings accounts or certificates of deposit (CDs).

Implementing these strategies requires discipline and planning. By making informed financial decisions, consumers can better protect their purchasing power and maintain financial stability during inflationary times.

In conclusion, adopting proactive financial strategies such as budgeting, investing, and negotiating can help you mitigate the negative impacts of inflation on your purchasing power, ensuring greater financial security.

| Key Point | Brief Description |

|---|---|

| 📊 Understanding CPI | The CPI measures the average change in prices consumers pay for goods and services. |

| 🔥 Inflation Impact | Rising CPI (inflation) reduces your purchasing power, making goods more expensive. |

| 🛡️ Protecting Power | Budgeting, investing, and negotiating salaries can help maintain purchasing power. |

| 🔄 CPI Updates | CPI updates reflect changing consumer habits, impacting inflation measurement. |

[Título da seção FAQ em en-US]

Frequently Asked Questions (FAQ)

▼

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

▼

The CPI measures inflation by tracking the price changes of a fixed basket of goods and services that represent typical consumer spending. An increase in CPI indicates inflation.

▼

The CPI is updated to ensure it accurately reflects current consumer spending habits and market conditions, which can change over time due to technology and preferences.

▼

Inflation reduces purchasing power, meaning you can buy less with the same amount of money as prices for goods and services increase.

▼

You can protect your purchasing power by budgeting, investing in assets that outpace inflation, negotiating higher wages, and saving strategically.

Conclusion

Understanding the Impact of the Updated Consumer Price Index (CPI) on Inflation and Your Purchasing Power is crucial for making informed financial decisions. By tracking the CPI, understanding how it measures inflation, and implementing strategies to protect your purchasing power, you can navigate economic fluctuations and maintain financial stability.