Great Depression vs. 2008 Crisis: Economic Stability Lessons for 2025

Comparing the Great Depression to the 2008 Financial Crisis offers critical economic stability lessons for 2025, highlighting the impact of policy interventions and regulatory frameworks on market resilience.

As global economies navigate persistent uncertainties, understanding historical financial downturns becomes paramount. Comparing the Great Depression to the 2008 Financial Crisis: Lessons for Economic Stability in 2025 reveals crucial insights into policy responses, regulatory frameworks, and the systemic vulnerabilities that can trigger widespread economic collapse. What can these monumental events teach us about safeguarding our future?

Understanding the Genesis of Economic Crises

Economic crises, while distinct in their immediate triggers and contexts, often share underlying vulnerabilities. The Great Depression, beginning in 1929, stemmed from a confluence of factors including rampant speculation, agricultural overproduction, and a fragile international financial system. The 2008 Financial Crisis, conversely, was primarily fueled by a housing market bubble, subprime mortgage lending, and complex financial instruments that obscured risk.

Both events demonstrated how easily a localized issue can cascade into a global catastrophe if left unaddressed. In 1929, the stock market crash quickly exposed deeper structural flaws, while in 2008, the collapse of mortgage-backed securities threatened the entire banking system. Understanding these origins is the first step in formulating robust preventative measures for economic stability in 2025.

Pre-Crisis Indicators and Warning Signs

Before each crisis, there were often overlooked or downplayed indicators. During the 1920s, rapidly increasing income inequality and an unsustainable credit boom signaled trouble. Similarly, the early 2000s saw an unprecedented rise in housing prices and lax lending standards.

- Great Depression: Excessive market speculation, agricultural distress, weak banking regulations.

- 2008 Crisis: Subprime mortgage proliferation, unregulated derivatives, housing bubble.

- Common Thread: A widespread belief in perpetual growth, leading to ignored risks.

These warning signs underscore the need for vigilant oversight and a willingness to act decisively, even when economic times appear prosperous. Ignoring these signals can lead to severe economic instability.

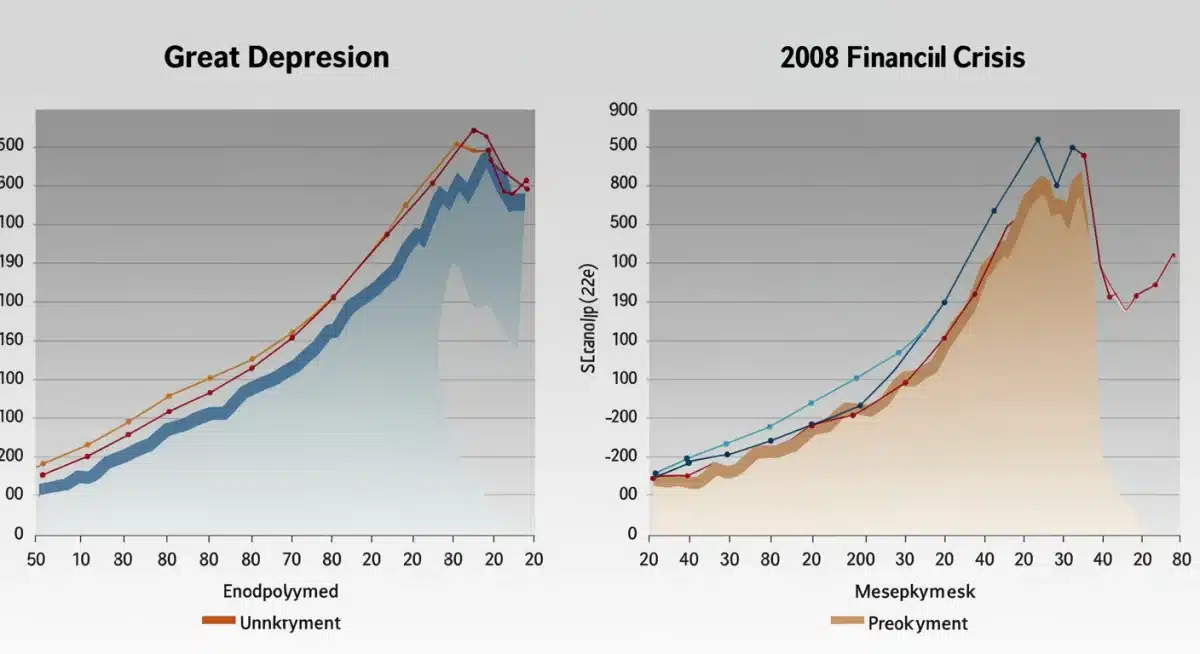

The Immediate Impact: Contraction and Unemployment

The immediate aftermath of both the Great Depression and the 2008 Financial Crisis was marked by severe economic contraction and soaring unemployment. The human cost was immense, with millions losing their jobs, homes, and life savings. These periods tested the resilience of societies and governments alike.

During the Great Depression, unemployment in the U.S. peaked at an estimated 25% by 1933, leading to widespread poverty and social unrest. The contraction of industrial output was staggering, with some sectors seeing declines of over 50%. The 2008 crisis, while less severe in terms of unemployment (peaking around 10% in the U.S.), still led to significant job losses and a deep recession, impacting global markets.

Government Response and Intervention

The scale of these crises necessitated unprecedented governmental intervention. In the 1930s, President Roosevelt’s New Deal introduced a series of programs aimed at relief, recovery, and reform, fundamentally changing the role of government in the economy. This included job creation programs, social security, and banking reforms.

Similarly, the 2008 crisis saw governments and central banks implement massive stimulus packages, bank bailouts, and quantitative easing programs. The Troubled Asset Relief Program (TARP) in the U.S. and coordinated international efforts aimed to prevent a complete collapse of the financial system. These interventions, though controversial, are widely credited with preventing an even deeper depression.

- New Deal Measures (1930s): Public works, social security, FDIC creation.

- 2008 Crisis Responses: TARP, quantitative easing, fiscal stimulus.

- Key Similarity: Expansion of governmental and central bank powers to stabilize markets.

Regulatory Reforms and Policy Evolution

Each major crisis has led to significant regulatory reforms designed to prevent future occurrences. The Great Depression spurred the creation of institutions like the Federal Deposit Insurance Corporation (FDIC) and the Securities and Exchange Commission (SEC), fundamentally reshaping the banking and financial markets. These reforms aimed to restore public trust and introduce greater transparency and oversight.

Following the 2008 Financial Crisis, the Dodd-Frank Wall Street Reform and Consumer Protection Act was enacted in the U.S., introducing sweeping changes to financial regulation. This included stricter oversight of banks, the creation of the Consumer Financial Protection Bureau (CFPB), and mechanisms to manage the failure of large financial institutions. These measures were intended to address the systemic risks exposed by the crisis and enhance economic stability for 2025 and beyond.

The Role of Central Banks

Central banks played a dramatically different, yet equally crucial, role in both crises. During the Great Depression, the Federal Reserve’s response was criticized for being too restrictive, exacerbating the downturn. Lessons learned from this period informed the more aggressive and expansive actions taken by central banks in 2008.

In 2008, the Federal Reserve, along with other global central banks, acted swiftly and decisively, lowering interest rates to near zero, providing liquidity to financial markets, and implementing unconventional monetary policies like quantitative easing. This proactive stance helped to prevent a complete meltdown and demonstrated the critical importance of a flexible and powerful central bank in times of crisis.

Global Interconnectedness and Contagion

A key lesson from both the Great Depression and the 2008 Financial Crisis is the profound impact of global interconnectedness. While the world economy in the 1930s was less integrated than today, the collapse of international trade and the spread of protectionist policies amplified the Depression’s severity worldwide.

The 2008 crisis vividly illustrated how financial shocks in one major economy can rapidly spread across the globe. The intricate web of international finance, with its cross-border lending and derivative markets, meant that the U.S. housing crisis quickly became a global financial contagion. This highlights the need for international cooperation and coordinated policy responses to maintain economic stability.

Preventing Future Global Shocks

For economic stability in 2025, understanding and mitigating global contagion risks is paramount. This involves strengthening international financial regulations, improving communication among central banks and regulatory bodies, and fostering a shared commitment to open trade and multilateral solutions.

- International Regulatory Bodies: Enhancing the power and coordination of groups like the Financial Stability Board.

- Cross-Border Stress Tests: Implementing global stress tests for financial institutions to identify systemic vulnerabilities.

- Trade Agreements: Promoting fair and open trade policies to prevent economic nationalism.

These measures aim to build a more resilient global financial architecture capable of withstanding future shocks.

Technological Advancements and Financial Innovation

The landscape of financial markets has been dramatically reshaped by technological advancements, posing both new opportunities and new risks for economic stability. While the Great Depression predates the digital age, the 2008 crisis highlighted how complex financial instruments, facilitated by technology, could obscure risk and accelerate contagion.

Today, the rise of fintech, cryptocurrencies, and artificial intelligence in financial trading introduces new challenges for regulators. These innovations offer efficiency and accessibility but also carry the potential for new forms of bubbles, rapid market shifts, and cyber vulnerabilities. Striking the right balance between fostering innovation and ensuring robust oversight is crucial for economic stability in 2025.

Regulating the Digital Frontier

Regulating emerging financial technologies requires a forward-thinking approach that can adapt to rapid changes. Traditional regulatory frameworks often struggle to keep pace with the speed of innovation, leaving potential gaps that could be exploited. International collaboration is essential, as digital finance often transcends national borders.

Policymakers must consider how to integrate new technologies into existing regulatory structures, or if entirely new frameworks are necessary. The goal is to harness the benefits of innovation while safeguarding against systemic risks. This proactive regulatory stance is vital for maintaining economic stability as the financial world evolves.

Lessons for Economic Stability in 2025

Drawing lessons from both the Great Depression and the 2008 Financial Crisis provides a critical roadmap for ensuring economic stability in 2025. Key takeaways include the necessity of robust regulation, agile central bank responses, and a deep understanding of systemic risks. Preventative measures must be dynamic, adapting to new financial innovations and global interconnectedness.

The past has shown that complacency is a dangerous foe. Continuous vigilance, transparent markets, and a commitment to address vulnerabilities before they escalate are paramount. As we look towards 2025, policymakers and financial institutions must remain proactive, learning from history to build a more resilient and equitable economic future.

Building a Resilient Economic Future

Achieving lasting economic stability requires a multi-faceted approach. This includes not only financial regulation but also addressing underlying societal issues such as income inequality and access to opportunities. A strong social safety net can act as a crucial buffer during economic downturns, mitigating the human cost and fostering quicker recovery.

Furthermore, investing in education, infrastructure, and sustainable practices can create long-term growth and stability. The lessons from past crises are not just about preventing collapse, but about building a foundation for sustained prosperity that benefits all segments of society. This holistic view is essential for navigating the complex economic challenges ahead.

| Key Point | Brief Description |

|---|---|

| Regulatory Evolution | Crises led to new bodies like FDIC (Great Depression) and Dodd-Frank (2008 Crisis), vital for 2025 oversight. |

| Central Bank Role | Shift from passive (1930s) to aggressive intervention (2008) highlights their crucial role for 2025 stability. |

| Global Interconnectedness | Both crises demonstrated global contagion, emphasizing the need for international cooperation for 2025. |

| Proactive Vigilance | Ignoring warning signs before crises underscores the need for constant monitoring to ensure 2025 stability. |

Frequently Asked Questions About Economic Crises and Stability

The Great Depression was caused by a combination of factors, including the 1929 stock market crash, banking panics, agricultural overproduction, and restrictive monetary policies. These elements created a vicious cycle of economic decline and high unemployment.

While both involved financial collapse, the 2008 crisis originated from a housing market bubble and complex financial instruments like subprime mortgages. The Great Depression was broader, stemming from multiple sectors and exacerbated by less effective central bank intervention.

The 2008 crisis led to the Dodd-Frank Act, increasing financial regulation, and aggressive monetary policies like quantitative easing by central banks. These measures aimed to stabilize the financial system and prevent future systemic risks.

Today’s highly integrated global economy means financial shocks in one region can rapidly spread worldwide. This necessitates international cooperation, coordinated regulatory efforts, and shared strategies to maintain economic stability and prevent contagion.

Technological advancements in finance (fintech, crypto) offer efficiency but also new risks like rapid market shifts and cyber vulnerabilities. Effective regulation must adapt to these innovations to ensure they contribute positively to, rather than threaten, economic stability.

Looking Ahead: Ensuring Economic Resilience

As 2025 approaches, the ongoing analysis of historical economic downturns, particularly Comparing the Great Depression to the 2008 Financial Crisis: Lessons for Economic Stability in 2025, remains crucial. Policymakers are actively monitoring global inflation trends, supply chain vulnerabilities, and geopolitical tensions, all of which could destabilize markets. The emphasis is on building greater resilience into financial systems and fostering international cooperation to address shared economic challenges. Vigilance against new forms of speculative bubbles and the effective regulation of emerging financial technologies will be paramount in safeguarding future prosperity. Proactive measures, rather than reactive ones, are the current focus to prevent another major crisis.