Fact Check: Are Home Insurance Premiums Really Up 15% Nationwide?

Reports of a 15% increase in home insurance premiums nationwide require careful examination. While average premiums are rising due to various factors like increased claims and inflation, a blanket statement of a 15% increase may not accurately reflect the experience of every homeowner.

Have you heard that home insurance premiums have spiked by 15% across the nation? Let’s dive into the Fact Check: Are Reports of a 15% Increase in Home Insurance Premiums Nationwide Accurate? to uncover the truth behind this claim and understand what’s really happening with insurance costs.

Understanding the Nationwide Home Insurance Premium Landscape

The home insurance market is dynamic, influenced by a multitude of factors that can cause premiums to fluctuate. Understanding these factors is crucial to interpreting reports of significant premium increases.

Several elements contribute to the overall cost of insuring a home. Let’s explore some factors.

Key Factors Influencing Home Insurance Premiums

Home insurance premiums are not arbitrary figures. They are calculated based on a comprehensive evaluation of risk, costs and market conditions.

- Increased Frequency and Severity of Claims: Natural disasters, such as hurricanes, wildfires, and floods, have become more frequent and intense, leading to higher claim payouts by insurance companies.

- Rising Construction and Repair Costs: The cost of building materials and labor has increased significantly, making it more expensive to repair or rebuild damaged homes.

- Inflation and Economic Factors: General inflation can drive up the cost of goods and services, including those associated with home repairs and insurance operations.

These factors collectively exert upward pressure on home insurance premiums, influencing the rates that homeowners ultimately pay.

In conclusion, understanding the factors that may impact the cost of home insurance can keep homeowners better-informed about potential cost shifts.

Analyzing the 15% Increase Claim: What the Data Says

Reports of a 15% increase in home insurance premiums nationwide have raised concerns among homeowners. However, a closer look at the data reveals a more nuanced picture.

Multiple sources provide insights into home insurance premium trends. Let’s evaluate some data points.

Examining Market Research and Reports

Various market research firms and insurance industry associations conduct studies on home insurance premium trends. These reports often provide valuable insights into average premium changes across different regions and demographics.

- State-Specific Variations: Premium increases can vary significantly from state to state, depending on factors such as local weather patterns, building codes, and regulatory environments.

- Coverage and Deductible Adjustments: Some homeowners may experience higher premiums due to changes in their coverage limits or deductible amounts.

- Individual Risk Profiles: Insurance companies assess each homeowner’s risk profile individually, taking into account factors such as the home’s location, age, construction materials, and claims history.

While some data may support the claim of a 15% average increase in certain areas or for specific policy types, it’s important to recognize that individual experiences can vary widely.

Understanding the nuances of home insurance data can help those interested make the most informed decisions.

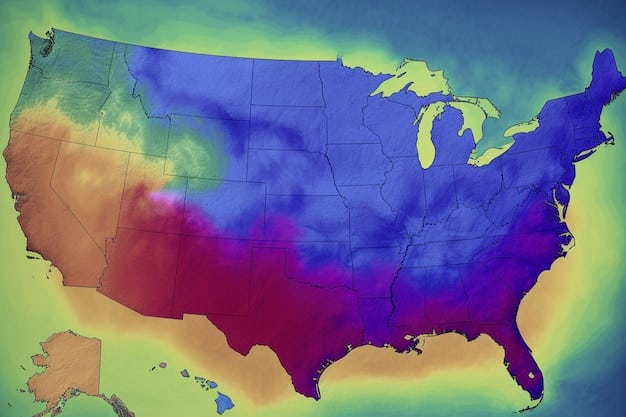

Geographic Disparities in Home Insurance Rate Hikes

One of the critical nuances often overlooked in nationwide reports of insurance premium increases is the significant geographic variation. Home insurance rates are highly localized.

The location of a home significantly impacts the premiums a homeowner will pay. Let’s see how location matters.

Regional Risk Factors

Different regions of the United States face different types of risks, and these risks are directly factored into home insurance premiums. Coastal areas, for example, are more vulnerable to hurricanes and tropical storms, while states in the Midwest are at higher risk of tornadoes.

- Coastal vs. Inland Rates: Homes located in coastal areas typically face higher insurance rates due to the increased risk of wind and water damage.

- Wildfire-Prone Areas: States like California, Oregon, and Colorado have seen significant increases in home insurance premiums due to the growing threat of wildfires.

- Flood Zones: Homes located in designated flood zones are required to carry flood insurance, which can add significantly to the overall cost of homeownership.

These regional risk factors play a crucial role in determining home insurance rates, leading to significant disparities across the country.

The risks associated with different geographic locations directly impact insurance rates, underscoring the need to consider regional considerations.

Factors Specific to Your Home That Affect Premiums

While macroeconomic trends and regional risks exert considerable influence on home insurance premiums, several property-specific factors can affect rates.

Homeowners should also be aware of the factors insurers consider such as claim history, credit rating and policy details.

Attributes Insurers Consider

Insurance companies assess a wide range of attributes when calculating premiums, looking at the likelihood and potential severity of claims.

Let’s analyze some of these property-specific attributes:

- Age and Condition of the Home: Older homes may be more vulnerable to certain types of damage due to outdated wiring, plumbing, or roofing.

- Construction Materials: The materials used to construct a home can affect its susceptibility to damage from wind, fire, or other perils.

- Claims History: Homeowners with a history of frequent or costly claims may face higher premiums.

By understanding the elements that affect rates, homeowners can assess the accuracy of reported premium increases and investigate if their individual rates vary substantially from averages.

The specific attributes of a property and its owner profile play a crucial role in determining home insurance rates.

Strategies for Managing and Potentially Lowering Premiums

While homeowners cannot control macroeconomic trends or natural disasters, there are several strategies they can use to manage and potentially lower their home insurance premiums.

Homeowners can take a proactive approach to managing risk.

Practical Steps You Can Take

By taking proactive steps to mitigate risks and shop around for the best rates, homeowners can exercise some control over their insurance costs.

- Regular Home Maintenance: Keeping your home in good repair can reduce the risk of certain types of damage, such as water leaks or roof failures.

- Bundling Policies: Many insurance companies offer discounts to customers who bundle their home and auto insurance policies.

- Increasing Deductibles: Opting for a higher deductible can lower your monthly premium, but it’s important to ensure that you can afford to pay the deductible in the event of a claim.

In addition, homeowners benefit from educating themselves about the factors that influence insurance rates and taking preventive measures to reduce their risk profile.

Effectively managing home insurance premiums involves a combination of risk mitigation, informed decision-making, and proactive shopping.

Conclusion: Separating Fact from Fiction in Home Insurance Claims

Reports of a 15% increase in home insurance premiums nationwide require careful scrutiny. While insurance costs are rising, a blanket statement of a 15% increase may not accurately reflect the experience of every homeowner.

Let’s look at some important considerations when interpreting insurance rate claims.

Key Takeaways for Homeowners

By staying informed, understanding their individual risk profiles, and taking proactive steps to manage their insurance costs, homeowners can navigate the complexities of the market with greater confidence.

- Consider Individual Circumstances: Home insurance premiums depend on numerous factors, and there’s no one-size-fits-all answer. What’s true for one region may not be true for another.

- Seek Professional Advice: Engaging with an independent insurance agent or broker can offer valuable insights and personalized recommendations.

- Take Preventative Steps: By improving the condition of their home and implementing risk-reduction measures, homeowners may be able to lower their insurance premiums.

The claim may hold true for certain homeowners in specific regions, while others might see smaller increases or a decrease in what they pay for home insurance policies.

In conclusion, interpreting insurance rate claims requires careful analysis of data, local trends and specific policy information.

| Key Point | Brief Description |

|---|---|

| 🏠 Premium Factors | Premiums are influenced by claims, construction costs, and inflation. |

| 🌎 Geographic Impact | Location greatly affects rates due to regional risks like hurricanes or wildfires. |

| 🔎 Risk Evaluation | Insurers assess individual risk based on home age, materials, and claims history. |

| 🛡️ Premium Control | Maintenance, policy bundling, and higher deductibles can help manage costs. |

FAQ: Home Insurance Premium Increases

▼

Yes, many homeowners are seeing increases, but averages vary due to location and policy specifics. Factors such as increased claims, rising construction costs, and inflation all play a role.

▼

Coastal areas face higher risks from hurricanes, tropical storms, and flooding. These risks can result in greater payouts, which leads to higher premiums.

▼

Yes, you can lower premiums by maintaining your home, bundling policies, or increasing your deductible. Shopping around and making sure you have right coverage are also beneficial.

▼

A history of frequent or costly claims can increase your premiums. Insurers view having several claims as a higher risk, so premiums tend to reflect that risk.

▼

Inflation increases the cost of goods and services, including construction and repair. As costs rise, insurance companies adjust premiums to cover these expenses.

Conclusion

In summary, while reports of a 15% increase in home insurance premiums may reflect a trend in some areas, it is essential to consider individual circumstances and location-specific factors. Keeping informed and staying proactive can help in managing your insurance costs effectively.