1929 Stock Market Crash: Navigating 2025 Economic Volatility

Understanding the 1929 Stock Market Crash provides crucial insights for navigating potential economic volatility in 2025, highlighting the importance of identifying speculative bubbles, assessing regulatory frameworks, and fostering economic resilience.

As financial markets brace for potential shifts, understanding the historical context of the 1929 Stock Market Crash to Navigate 2025 Economic Volatility: 3 Key Takeaways (RECENT UPDATES) becomes critically important. This historical event offers invaluable lessons for investors, policymakers, and the general public seeking to comprehend and mitigate future economic downturns.

The Roaring Twenties and the Seeds of Collapse

The period leading up to the 1929 Stock Market Crash, often dubbed the “Roaring Twenties,” was characterized by unprecedented economic growth and widespread optimism in the United States. This era saw rapid industrial expansion, technological advancements, and a booming stock market that captivated the nation. However, beneath the surface of prosperity, several underlying issues were setting the stage for a dramatic downturn, issues that echo in current economic discussions.

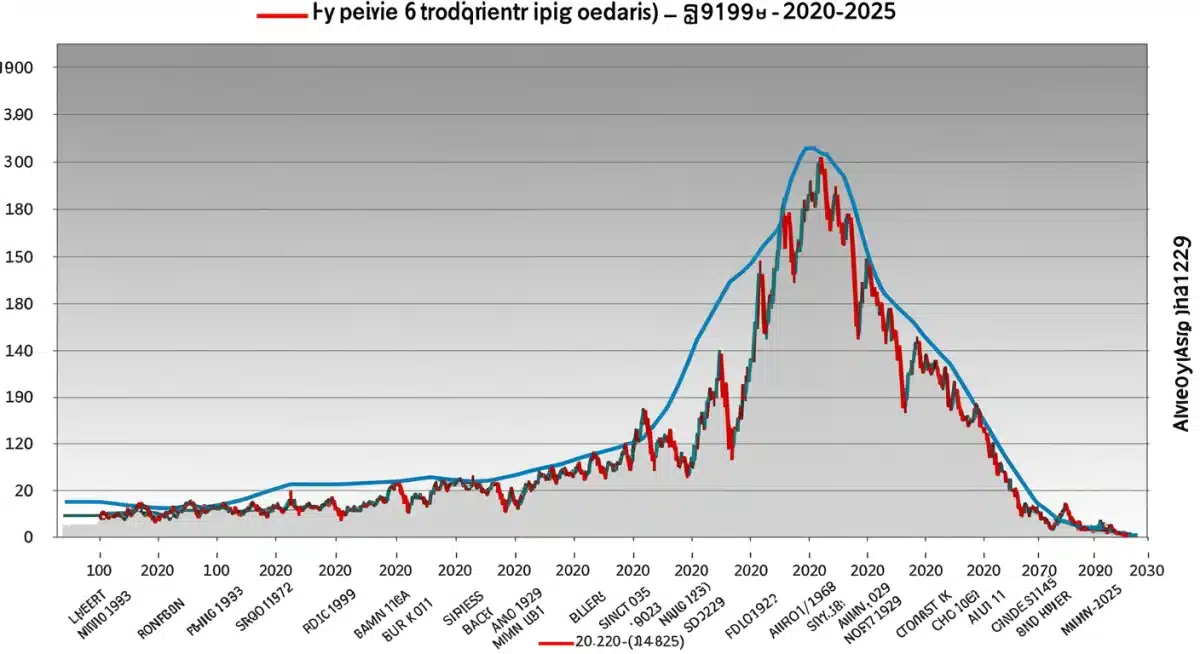

Speculative fervor became rampant, with many ordinary citizens investing heavily in stocks, often on margin, believing that the market would continue its upward trajectory indefinitely. This speculative bubble inflated asset prices far beyond their intrinsic value, creating an unstable foundation for the economy. The rapid increase in stock prices was not always matched by corresponding growth in corporate earnings or productivity, indicating an unsustainable trend. Recent analyses suggest that similar speculative behaviors, fueled by readily available credit and market enthusiasm, are points of concern as we look towards 2025.

Unchecked Speculation and Margin Buying

One of the primary drivers of the pre-crash boom was the pervasive practice of buying stocks on margin. This allowed investors to purchase shares with a small down payment, borrowing the rest from brokers. While profitable during rising markets, this practice amplified losses when prices fell, leading to devastating consequences.

- Easy Credit: Banks and brokers offered credit with minimal restrictions, encouraging widespread participation in the stock market.

- Market Euphoria: A prevailing belief that stock prices would only go up led many to disregard fundamental financial principles.

- Amplified Risk: Margin calls, triggered by falling stock prices, forced investors to sell, accelerating the market’s decline.

The lack of robust regulatory oversight allowed these risky practices to proliferate, creating a highly vulnerable financial system. The lessons here are stark: unchecked speculation, particularly with borrowed funds, can lead to catastrophic market corrections. As of recent updates, discussions around regulating leveraged trading and cryptocurrency markets highlight similar concerns about systemic risk.

Black Thursday and the Great Depression’s Onset

Black Thursday, October 24, 1929, marked the dramatic beginning of the end for the speculative boom. On this day, the stock market experienced a sharp and sudden decline, signaling the end of the “Roaring Twenties.” While efforts were made by leading bankers to stabilize the market, the panic had already set in, leading to even more severe drops in the following days, culminating in Black Tuesday. This period serves as a stark reminder of how quickly market sentiment can shift and the profound impact of investor fear.

The crash quickly spiraled into the Great Depression, a decade-long economic crisis that affected global economies. The immediate aftermath saw widespread bankruptcies, mass unemployment, and a drastic reduction in consumer spending. The interconnectedness of the financial system meant that the stock market collapse rapidly impacted banks, businesses, and individuals, illustrating the domino effect of financial contagion. Understanding these immediate consequences helps contextualize the potential ripple effects of future market instabilities.

Bank Failures and Economic Contagion

The stock market crash severely weakened the banking system. Banks had invested heavily in the stock market and extended loans to individuals and businesses for speculative purposes. As stock prices plummeted and borrowers defaulted, many banks faced insolvency.

- Run on Banks: Public fear led to widespread withdrawals, as people rushed to retrieve their savings, further destabilizing financial institutions.

- Credit Crunch: The collapse of banks severely restricted the availability of credit, stifling business investment and economic activity.

- Global Impact: The crisis in the U.S. quickly spread internationally, as American banks recalled foreign loans and reduced investments abroad, impacting economies worldwide.

The lack of federal deposit insurance at the time meant that depositors lost their life savings when banks failed, exacerbating the economic downturn. This historical precedent underscores the critical role of robust financial safeguards and international cooperation in managing economic crises. Recent economic reports emphasize the importance of central bank policies in maintaining liquidity and preventing similar systemic collapses.

Key Takeaway 1: Identifying Speculative Bubbles

One of the most crucial lessons from the 1929 crash is the importance of recognizing and addressing speculative bubbles before they burst. A speculative bubble occurs when asset prices rise rapidly and are driven by irrational exuberance rather than fundamental value. In the 1920s, this was evident in the widespread belief that stock prices would continue to climb indefinitely, fueled by easy credit and public enthusiasm, detached from actual corporate performance or economic output.

For navigating 2025 economic volatility, understanding how to identify these bubbles is paramount. Key indicators include rapid price increases in specific asset classes (e.g., tech stocks, real estate, cryptocurrencies), high trading volumes driven by retail investors, and the widespread use of leverage. Policymakers and investors must look beyond immediate gains to assess the underlying health of market valuations. The recent surge in certain asset classes has prompted economists to draw parallels, urging caution and a closer examination of market fundamentals.

Warning Signs of Market Overheating

Recognizing the signs of an overheated market is essential for proactive risk management. These indicators often involve a disconnect between asset prices and their intrinsic value, coupled with excessive optimism.

- Price-to-Earnings Ratios: Unusually high P/E ratios, especially across broad market segments, can signal overvaluation.

- Retail Investor Participation: A significant increase in inexperienced retail investors entering speculative markets, often with borrowed money.

- Media Hype: Extensive media coverage portraying quick wealth gains and downplaying risks, creating a ‘fear of missing out’ (FOMO) mentality.

These warning signs, when observed collectively, suggest that a market may be driven more by speculation than by sound economic principles. Vigilance in monitoring these indicators can help prevent individuals and institutions from being caught off guard by sudden market corrections. As of recent data, certain sectors are exhibiting characteristics that warrant careful monitoring, according to financial analysts.

Key Takeaway 2: The Role of Regulation and Policy

The aftermath of the 1929 crash highlighted the severe inadequacies in financial regulation and economic policy. Prior to the crash, there was minimal government oversight of the stock market and banking system, allowing risky practices to flourish unchecked. This lack of regulation contributed significantly to the severity and duration of the Great Depression. The response to the crisis, particularly the New Deal reforms, laid the groundwork for modern financial regulation, demonstrating the critical need for proactive governmental intervention.

For 2025, the lessons on regulation and policy are clear: robust and adaptive regulatory frameworks are essential to maintain financial stability and protect against systemic risks. This includes oversight of banking, securities markets, and emerging financial instruments. Policymakers must continuously evaluate and update regulations to address new challenges and prevent the recurrence of past mistakes. The ongoing debates around cryptocurrency regulation and the stability of the global financial system underscore this enduring relevance.

Building Financial Safeguards

The post-1929 era saw the implementation of landmark legislation designed to prevent future financial catastrophes. These reforms created institutions and rules that are still fundamental to today’s financial system.

- Securities and Exchange Commission (SEC): Established in 1934, the SEC was created to regulate the stock market and protect investors from fraud and manipulation.

- Federal Deposit Insurance Corporation (FDIC): Introduced in 1933, the FDIC insured bank deposits, restoring public confidence in the banking system and preventing bank runs.

- Glass-Steagall Act: Separated commercial and investment banking, aiming to reduce risky financial practices by restricting banks from engaging in both.

These policies were instrumental in stabilizing the financial system and fostering a more secure economic environment. The continuous evolution of financial markets necessitates an equally adaptive regulatory approach. Recent policy discussions emphasize the need for international coordination in regulating global financial flows and digital assets to prevent cross-border contagion.

Key Takeaway 3: Economic Diversification and Resilience

A significant factor contributing to the severity of the 1929 crash’s aftermath was the U.S. economy’s over-reliance on a few key industries and a lack of diversification. When these sectors faltered, the entire economic structure suffered profoundly. The agricultural sector, for instance, was already struggling before the crash, and its collapse exacerbated the broader economic downturn. This highlights the dangers of a concentrated economy vulnerable to shocks in specific areas.

As we look towards 2025, fostering economic diversification and resilience is a critical strategy for mitigating future volatility. Economies that are broadly diversified across various industries, technologies, and global markets are better equipped to absorb shocks in any one sector. This involves promoting innovation, supporting small and medium-sized enterprises, and investing in a broad range of human capital. Governments and businesses are increasingly focusing on building supply chain resilience and fostering multiple growth engines to withstand unforeseen disruptions.

Strategies for Building Resilience

Developing a resilient economy involves conscious efforts to spread risk and cultivate multiple sources of growth. This proactive approach can buffer against external shocks.

- Investment in R&D: Encouraging research and development across diverse sectors can spur new industries and job creation.

- Support for SMEs: Small and medium-sized enterprises are often drivers of innovation and job growth, contributing to a more robust economic base.

- Global Trade Relations: Diversifying trade partners and export markets reduces dependence on any single country or region, mitigating geopolitical and economic risks.

These strategies aim to create an economy that is not only robust but also adaptable to changing global conditions. The emphasis on green technologies and digital transformation in recent economic plans reflects a commitment to building new, resilient sectors that can drive future growth. As of recent reports, many nations are actively pursuing policies to enhance their economic resilience in preparation for potential global uncertainties.

Comparing 1929 to 2025: Modern Economic Volatility

While direct comparisons between the 1929 crash and potential 2025 economic scenarios must account for vastly different economic structures and regulatory environments, historical patterns offer valuable insights. The 1929 crash occurred in an era of nascent financial regulation, limited social safety nets, and a gold standard that restricted monetary policy flexibility. Today, we have sophisticated central banks, federal deposit insurance, and a globalized financial system with intricate interdependencies. However, new forms of volatility and risk have emerged, demanding constant vigilance.

Modern economic volatility is often driven by factors such as rapid technological change, geopolitical tensions, climate change impacts, and the interconnectedness of global supply chains. The speed at which information and capital flow globally means that shocks can propagate much faster than in 1929. Understanding these contemporary drivers of volatility, while learning from historical precedents, is key to developing effective mitigation strategies. Recent analyses indicate that while the specific triggers may differ, the underlying human behaviors of fear and greed remain constant in financial markets.

New Challenges in Global Markets

Current economic landscapes present unique challenges not present in the 1920s, requiring updated approaches to risk management and policy.

- Digital Assets: The rise of cryptocurrencies and decentralized finance introduces new regulatory complexities and potential sources of systemic risk.

- Geopolitical Fragmentation: Increasing trade protectionism and geopolitical conflicts can disrupt global supply chains and economic stability.

- Climate Change: The economic costs of climate-related disasters and the transition to green economies present both risks and opportunities for investment and growth.

These modern factors necessitate a flexible and forward-thinking approach to economic policy and investment decisions. The ability to adapt to these evolving challenges will be crucial for navigating the economic landscape of 2025 and beyond. As of the latest economic forecasts, central banks and international organizations are actively collaborating to address these multifaceted risks.

| Key Takeaway | Brief Description |

|---|---|

| Identify Speculative Bubbles | Recognize rapid asset price increases driven by irrational exuberance, not fundamental value, to avoid market pitfalls. |

| Robust Regulation & Policy | Implement and adapt strong financial regulations to prevent systemic risks and maintain market stability. |

| Economic Diversification | Foster a broad range of industries and global markets to build resilience against economic shocks. |

Frequently Asked Questions About Economic Volatility

The 1929 Stock Market Crash was primarily caused by widespread speculative buying, particularly on margin, which inflated stock prices far beyond their fundamental values. This unsustainable bubble, combined with a lack of regulation and underlying economic weaknesses, led to a sudden and severe market correction.

Investors can identify speculative bubbles by observing unusually high price-to-earnings ratios, significant entry of inexperienced retail investors, and pervasive media hype. A disconnect between rapid asset price increases and underlying economic fundamentals often signals a bubble formation.

Government regulations are crucial for preventing economic crises by ensuring financial stability, protecting investors, and curbing excessive risk-taking. Institutions like the SEC and FDIC, established after 1929, provide oversight and safeguards that help maintain confidence in the financial system.

Economic diversification enhances national resilience by spreading economic activity across various industries and markets. This reduces dependence on any single sector, making the economy less vulnerable to shocks in specific areas and better equipped to absorb downturns.

While direct parallels are complex due to modern financial structures, some similarities exist in speculative fervor in certain asset classes. However, today’s robust regulatory frameworks and monetary policy tools offer greater protection against a repeat of the 1929-style collapse.

What This Means for 2025

The lessons from the 1929 Stock Market Crash remain highly pertinent as global economies grapple with ongoing uncertainties heading into 2025. Policymakers and investors must remain vigilant, scrutinizing market indicators for signs of speculative excess and ensuring that regulatory frameworks are robust enough to address emerging financial technologies and global interdependencies. The emphasis on fostering diversified and resilient economies, capable of weathering both anticipated and unforeseen shocks, will be paramount. Monitoring central bank actions, international trade dynamics, and technological disruptions will provide critical insights into navigating the evolving economic landscape and mitigating potential volatility.